Entrepreneurs, by nature, are a competitive breed. Every business owner should want to know how they compare to their competitors, peers, and industry.

As a clinic owner, you want to know that your reports are organized correctly so you can appropriately compare your financials according to industry benchmarks.

Between one dental practice and another, each line on a report or income statement could mean one thing for some, and an entirely different thing for another. For example, "supplies" in one practice might mean dental supplies, small equipment, and maintenance but in another practice, it could refer to dental supplies alone. ‘Wages’ could account for payment of the entire staff and associate dentists, or there could be a separate line for ‘doctor’s pay.’

This is a problem.

Without standardizing your Profit and Loss statements, it will be difficult to compare your performance to industry benchmarks.

Still with us? Perhaps you’re a little confused but find yourself relating to these various scenarios and maybe even asking those same questions as well.

In this article, we tackle the importance of standardizing reporting, why benchmarking is critical for your clinic’s success, and provide you with a sample income statement with an overview on how to implement the key changes to make this process a breeze for you going forward.

You might be wondering, why is it important to standardize accounting practices for dental clinics?

The answer is simple. It’s all about benchmarking.

Benchmarking allows for comparisons to be made between practices and against industry standards. If you don't set up your dental practice's P&L correctly, then you will not be able to compare your performance to the industry. You need to set up your reporting system correctly in order to spot areas of concern so you can address them.

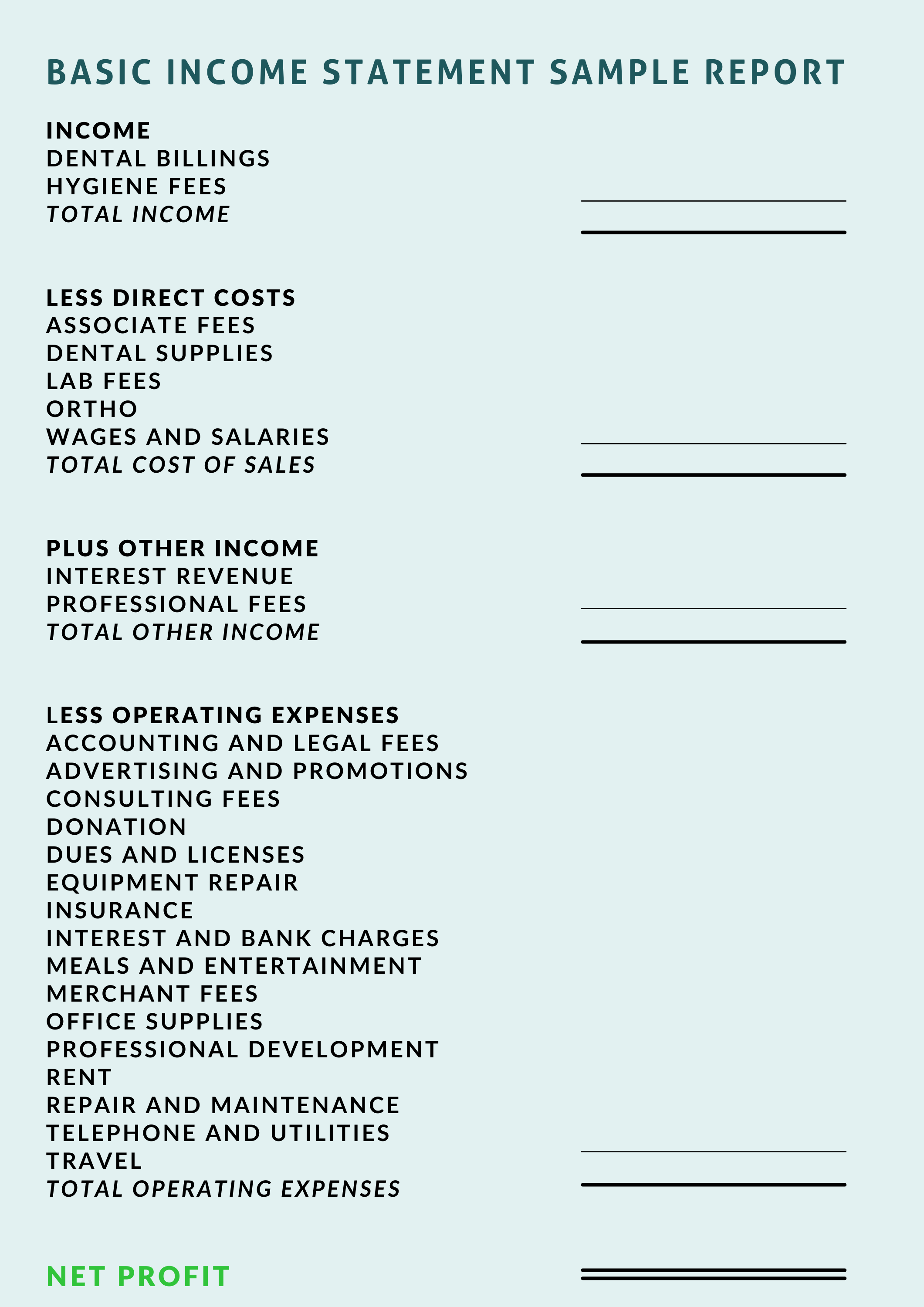

So what should a standardized basic report look like?

Well, to start, here is a sample we provide along with an easy-to-follow guide on how to put your report together and define each line.

Step One - Production

- Split your dental billing from hygiene fees.

- It’s important to differentiate the two so you can understand the sources of revenue.

- This way you are aware of how much is coming from dentistry vs how much is coming in from hygiene with each service.

Step Two - Break down the Direct Costs This includes:

- Associate fees

- Dental supplies (make sure to define orthodontic supplies from dental/or implants

- Lab fees - all lab fees paid should be in one line item

- Wages - staff salaries (not including any wages paid to family members).

Step Three - What are your Other Sources of Income?

- Investments

- Interest on savings

- Other business enterprises

- Always ensure that you are separating your business income from revenue from other sources (interest, investments, etc)

Step Four- Operating Expenses Here are a few mainline items under overhead expenses

- Accounting/legal fees

- Advertising and promotions

- Consulting fees

- Dues and licenses

- Equipment repair

- Rent & utilities

- Office supplies

- Merchant fees

- Janitorial

- Management salary

Next steps

- Start by making sure you are accurately defining your lines, aligning your reports, and have an understanding of how your P&L reports are organized.

- Have a conversation with your accountant/bookkeeper to identify what is being recorded under each line in the P&L

- Once the above is completed, take a look at your P&L (profit and loss), compare how you’re doing with the industry benchmarks. Take action as necessary from there.

Shift Accounting works with over 80 successful clinics across Canada. We go beyond basic book-keeping, providing a range of financial and administrative services, as well as consulting and CFO contracting. We are invested in your success. Contact us today for more information on how you can take the next step to grow your practice and build a more profitable business.